artworks, artists and exclusive offers. Sign up now

[NEWS] Masterworks, An Online Investment Platform, Is Now Valued at Over $1 Billion

October 07, 2021

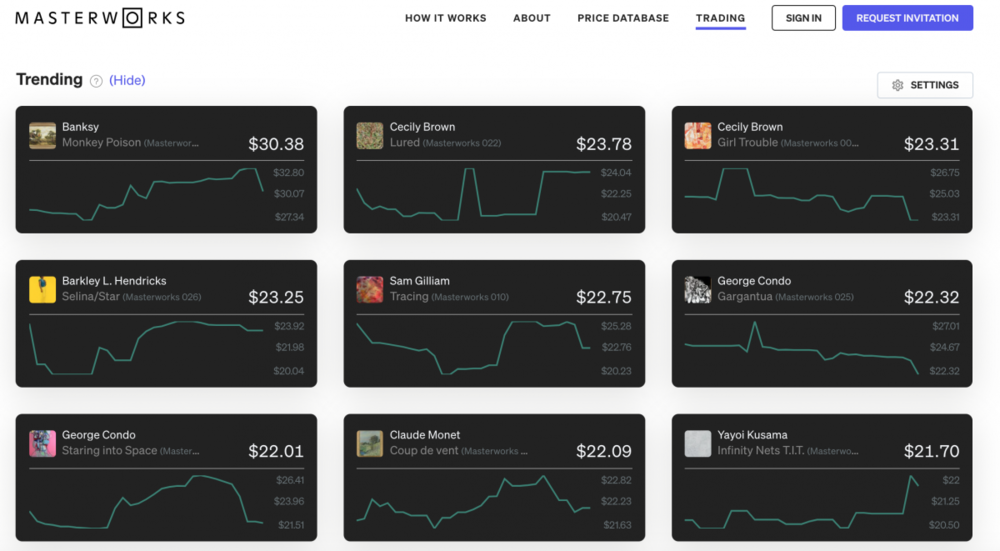

Masterworks interface. (Courtesy: Masterworks)

Masterworks, an online investment platform founded in 2017 that sells

shares in blue-chip art, has received $110 million in a first round of funding

from New York–based venture fund Left Lane Capital and other investment firms,

including Tru Arrow Partners and Galaxy Interactive. With this round of

funding, the company said it was now valued in excess of $1 billion, and marks

a milestone for the platform, which has seen its member base grow steadily over

the past year.

As investors look to diversify their holding amid

exceptionally top-heavy traditional asset markets, more tech-enabled platforms

are popping up to make the case for their alternative investment platform of

choice. Masterworks, a startup that sells fractionalized shares of paintings

and other works by famous artists, has achieved a unicorn valuation as it looks

to corner the market on bringing fine art exposure into people’s portfolios.

The members-only platform, which has a staff of 100 employees with

headquarters in New York’s Tribeca neighborhood, allows investors to buy and

sell shares of major works of art by the likes of Jean-Michel Basquiat, Keith

Haring, and Pablo Picasso, among others.

“Art is among the largest asset classes remaining that has never been

securitized,” said the platform’s founder Scott

Lynn. The New York–based

entrepreneur will allocate the funds from the investments to growing the

business, including costs around distribution and financial advisors.

Masterworks buys and stores a number of paintings by

famed contemporary artists like Andy Warhol, Keith Haring, Jean-Michel Basquiat

and Yayoi Kusama, selling shares in qualified public offerings that are

registered with the SEC, allowing investors to trade those shares on its

secondary market once an offering closes. Shareholders get paid out when

Masterworks eventually sells a painting. The startup makes money by selling

those paintings at a profit, earning 20% of the profit each time a painting

sells alongside a 1.5% per year management fee on each piece of artwork.

As of October, more than 200,000 members have signed up for Masterworks,

which also includes data on

historical sales to better gauge what an

artists’ work might return. Of that group, some 15,000 members have purchased

shares in artworks that are traded on the platform. The company acquires each

individual work and registers it with the U.S. Securities and Exchange

Commission (SEC). From there, investors are able to buy shares in the pieces.

| Prev | [NEWS] “Wong Ping: Your Silent Neighbor” At The New Museum |

|---|---|

| Next | [NEWS] Guadalupe Maravilla Receive The Lise Wilhelmsen Art Award, One of the World’s Largest Art Pri |

| List |